Most business owners take insurance into consideration. Typically they consider the coverage they'll need for bodily injury and property damage. Some business owners may also consider coverage for liquor risks or even business auto exposures. What is commonly overlooked is cyber liability coverage.

According to CyberScout, a global leader in cybersecurity and identity theft resolution services, 76% of US small and medium-sized businesses (SMBs) experienced some form of cyberattack, but only 31% of those businesses had cyber insurance coverage.

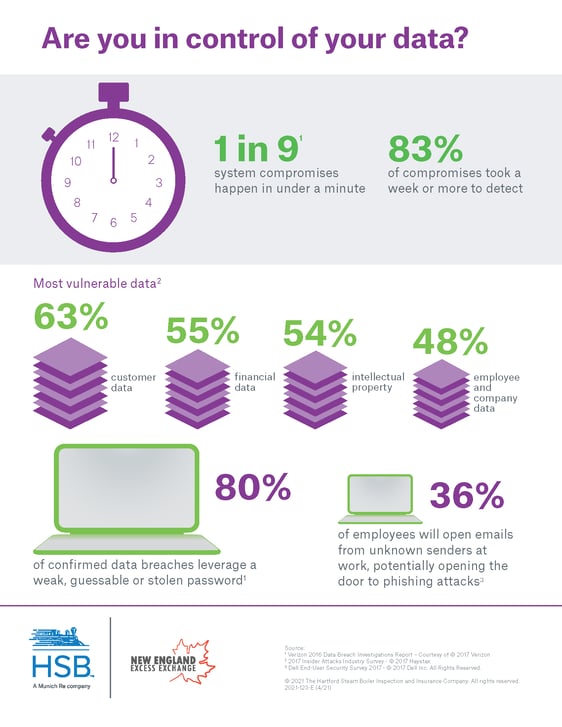

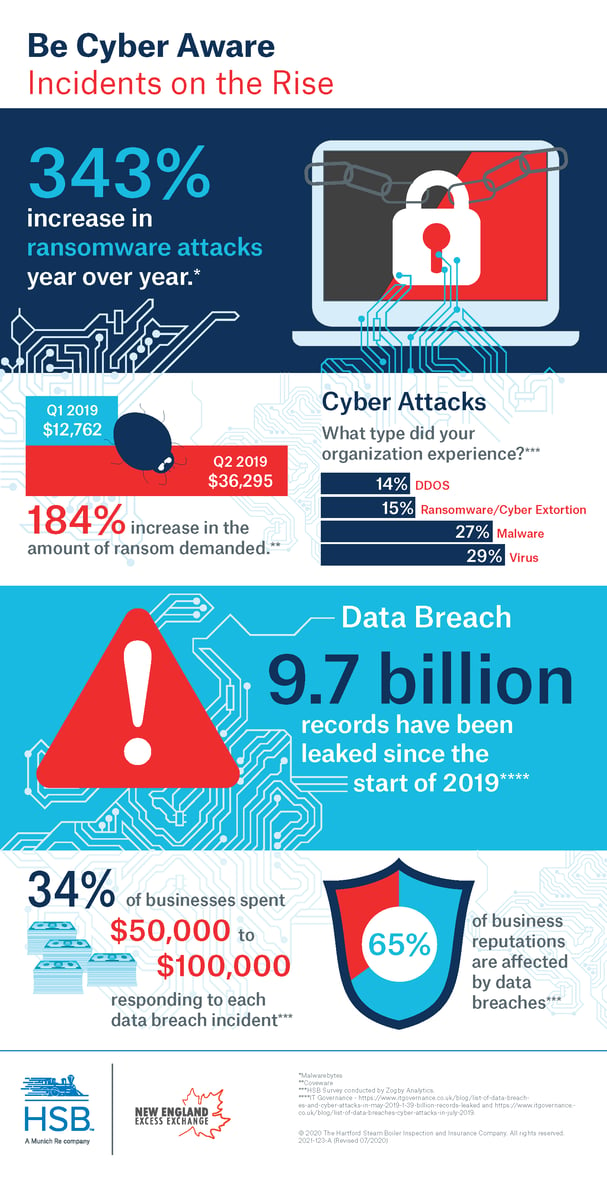

So how do you convince your commercial clients to invest in cyber coverage? How can you get the conversation moving? Consider sharing some of these surprising statistics from our friends at HSB ↓

We hope this information from our carrier partner can help you convey the importance of cyber coverage. To learn more about our Cyber Liability options visit https://neee.com/cyber.

.png?width=449&name=Cyber%20Liability%20CTA%20-%20Blog%20(1).png)